Venerate Acquisition to Boost Loans and Net Income

As declared by SASR a month ago and emphasized in the 3QFY19 phone call, SASR will pick up around $11 billion in resources from its obtaining of Revere Bank. The obtaining is intended to be shut before the finish of the main quarter of 2020. As Revere Bank had around $2.3 billion in credits toward the finish of June 2019 (source: 2Q income), I'm anticipating that SASR's advance portfolio should ascend by that sum one year from now. I'm additionally expecting natural mid-single digit development of SASR's advance book outside of the Revere obtaining. The ascent in advances will be the significant driver of overall gain in 2020.

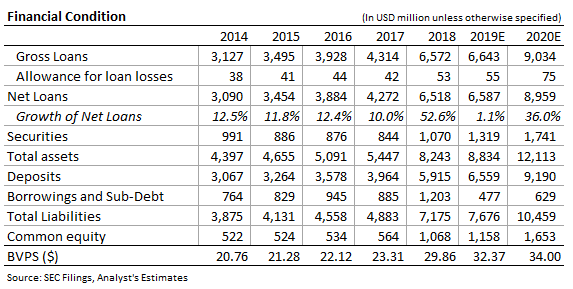

The obtaining will prompt development in the remainder of the accounting report too. I'm anticipating that SASR's value should ascend by around $500 million one year from now, with $400 million inferable from the obtaining, which will build normal stock and extra paid-in capital. I'm additionally anticipating that the quantity of offers should increment to 48.6 million after the merger from the current 35.8 million. My supposition that depends on the merger understanding wherein 1.05 portions of SASR are to be given to holders of Revere Bank for each offer that they possess. The value and number of offers exceptional presumptions lead to book esteem per share, BVPS, gauge of $34 for end of 2020. My appraisals for SASR's credits and other key asset report things are given in the table underneath.

Sandy Spring Bancorp Balance Sheet Forecast

Decrease in Expensive Borrowing to Buoy NIM in 2020

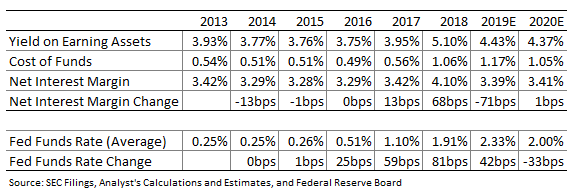

SASR's store development has far outpaced advance development this year, which has enabled the organization to lessen greater expense borrowings. SASR's borrowings declined to $681 million before the finish of September 2019 from $1,203 million toward the finish of December 2018. This decrease in costly obtaining will help SASR's net intrigue edge, NIM, in a declining loan fee condition. SASR's NIM will likewise get some help from the Revere Bank securing. Thusly, I'm anticipating that NIM should be generally steady in 2020 contrasted with 2019.

Sandy Spring Bancorp Net INterest Margin

The administration anticipates that NIM should be in the scope of "mid-3.40s" in the final quarter. In view of this direction, I'm anticipating that NIM should be around 3.47% in 4QFY19.

Non-Interest Income to Normalize in the Fourth Quarter

As referenced in the 3QFY19 phone call, SASR booked non-repeating pay of around $1.2 million from FDIC Insurance refund in the second from last quarter. As indicated by the administration, this salary may not stream again in the final quarter, and on the off chance that on the off chance that SASR gets refund again in the quarter, at that point it will be just about portion of what the organization got in the second from last quarter. Thusly, I'm expecting non-intrigue pay to decrease in the last quarter of 2019. For 2020, I'm expecting non-premium pay to be driven upwards by the Revere Bank securing.

Merger Expenses to Constrain Earnings Next Year

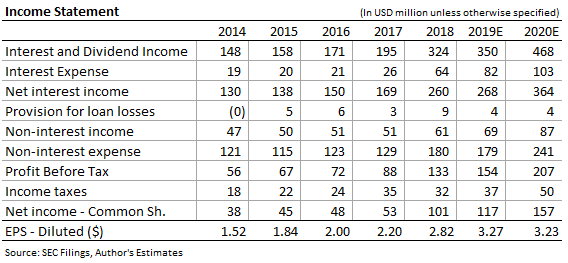

Merger costs are required to oblige profit in the initial 75% of one year from now, after which these costs are relied upon to decay to zero. Aside from merger-related costs, SASR's non-intrigue costs are likewise liable to rise normally. The administration expects natural development of 4% to 5% on an annualized premise. The table beneath shows my salary articulation gauges for 2020, which are for the most part dependent on the executives' direction and the merger-related subtleties presently accessible. I will refresh my appraisals as more insights regarding the merger and related expenses become accessible in the following telephone call.

Sandy Spring Bancorp Income Forecast

Prior to the procurement, non-intrigue cost is relied upon to witness flattish development as SASR booked one-time costs of around $2.2 million in the second from last quarter, which won't repeat in the coming quarters.

Profits Likely to Continue to Rise

I expect SASR's rising profit pattern to proceed one year from now, with quarterly profit ascending to $0.32 per share in 2020 from the current $0.30 per share. My desire is inferable from an agreeable suggested payout proportion of 39.6% for one year from now. The 2020 profit gauge proposes a profit yield of 3.71%.

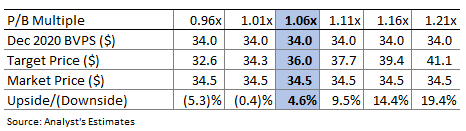

Valuation Analysis Suggests Only a Small Upside

SASR's cost to book proportion, P/B, has been unstable before this year, so I'm utilizing just 2019's normal P/B various to esteem the organization. SASR has exchanged at a normal various of 1.06 this year. Duplicating this normal proportion with the conjecture book esteem per portion of $34 gives an objective cost of $36 for December 2020. The value target offers just a 4.6% upside from SASR's October 23, 2019, shutting cost.

Sandy Spring Bancorp Valuation Sensitivity

CONCLUSION: Downgrading to Neutral Stance

My last report, which was given before the merger declaration, received a bullish position on the stock. I'm currently decreasing my objective cost to $36.0 from my past target cost of $38.8 as I anticipate that income should plunge marginally one year from now on the back of merger-related costs. As the new target cost suggests just 4.6% upside, I'm receiving an impartial position on the stock. I prescribe putting resources into SASR if its value plunges to $32.8, which is 10% underneath the objective cost.

No comments:

Post a Comment